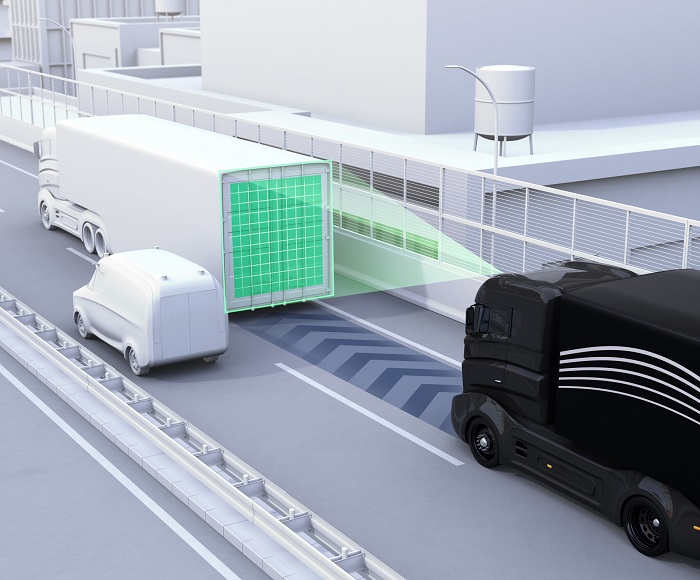

Could your company soon begin using driverless trucks? These vehicles operate in such a manner as not to rely on a human to move them. Their ultimate, long-term goal is to require no human to be present to move material.

Imagine how this might change the way you do business. It might mean moving materials with less risk and dependency on a driver. But, what does it mean right now? Some people are beginning to put these vehicles into place, and they are seeing numerous benefits from doing so.

Driverless Vehicles Are Still The Unknown

One of the most important things for business owners to know is that driverless vehicles are coming. However, they are fully integrated into the trucking network yet. As they begin to hit the road in states like California, Nevada, and Ohio, we will likely begin to see changes. For example, your commercial auto insurance rates are not likely to change immediately. But in the long term, they may fall significantly.

Why are commercial auto insurance rates expected to fall? It's because many of the claims made on these policies extend from human error. For example, a person may have failed to obey a law. A driver might have fallen asleep and caused an accident. Or, cargo may have suffered damage due to poor installation.

When these claims are filed, the insurer pays them out. However, in the long term, the number of risks will be minimal. Automation and driverless trucks will reduce opportunities for human error.

The hope is for these vehicles to reduce accidents. And the goal is for them to minimize the impact of the truck driver shortage.

At the same time, we have to realize that risk will always be present. Breakdowns can occur, and machines can make mistakes. Should this happen, your commercial auto insurance might help cover these losses.

This means it's critical that companies considering the move into automation let their insurance agent know their plans. The agent will work to determine if this type of action could help reduce premiums, and to ensure that the vehicles have the specific coverage to meet their needs. In some cases, it could also reduce your premiums significantly.

Companies should not shy away from investing in this new technology as long as they feel it is safe to do so. Automation and autonomous systems like this could offer your company many benefits. To achieve those benefits, though, you'll need to keep your insurance agency up to date. Contact California Church Insurance Services today to get started!